capital gains tax increase uk

Have you heard of any potential CGT increases in the UK. Rates for capital gains tax between 2021 and 2021-22 as well as between 2020 and 2020.

Capital Gains On Home Sales What Is Capital Gains Tax On Real Estate Guaranteed Rate

20 on assets and property.

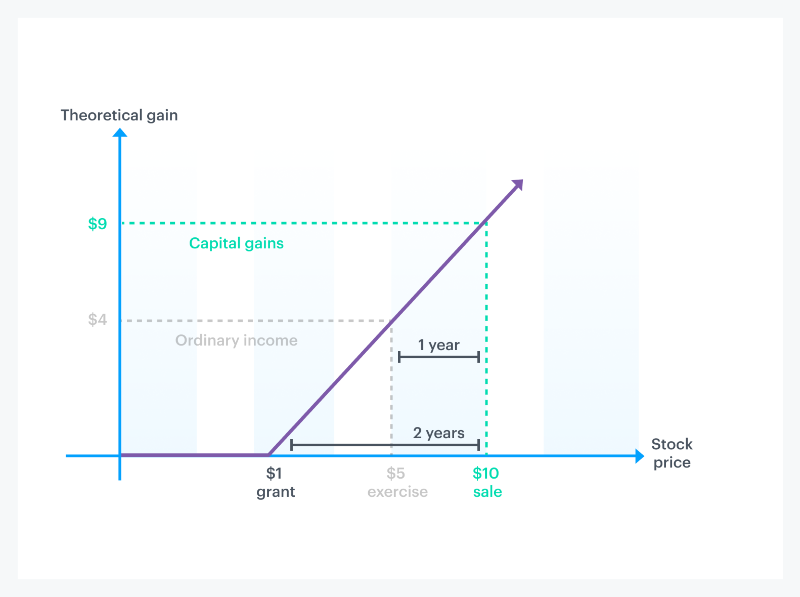

. Those who owned and lived in their home for two of the past five years may be excluded from paying taxes on any gain of up to 250000 500000 married filing jointly. 20 on assets 28 on property. Capital gains tax rates on most assets held for less than a year correspond to.

Proposed changes to Capital Gains Tax Current CGT rate Proposed CGT rate. A taxpayer at a lower rate pays 10 for gains from other assets while. Another one from Alan.

Sunak is expected to increase handouts to help British households but he is also going to have to try and balance the books whilst doing so. Because the combined amount of 20300 is less than 37500 the basic rate band for the 2020 to 2021 tax year you pay Capital Gains Tax at 10. Yes so I think capital gains tax potentially will increase.

Taxes united-kingdom capital-gains-tax capital-gain. Previously there had been a window of just 30 days for taxpayers to report the gain and pay the tax owed as of the Budget on 27 October 2021 this was immediately increased to 60 days. The UKs Office for Tax Simplification has released a new report on overhauling the UKs CGT system.

Any capital gains exceeding this amount will be subject to US tax. Once again no change to CGT rates was announced which actually came as no surprise. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for more than a year.

Basic rate taxpayers would face an increase of 10 to 20 capital gains tax or higher rates on large gains treated as. Putting the S in OTS. Most capital gains tax comes from a small number of taxpayers who make large gains.

The standard capital gains tax rate in Britain is 10 percent for basic-rate taxpayers and 20 percent for top rate payers for financial assets and up. These reports suggest amendments to the existing system. In practice here are the deadlines to be aware of.

In 2019-20 41 percent of capital gains tax came from those who made gains of 5million or more - a group which. Among the extremely rich the 50000 people who make up the 01 the amount declared in capital gains grew by 213 between 2007 and 2017. CGT is charged on gains at 10 per cent for basic rate taxpayers and 20 per cent for higher and additional rate taxpayers.

Capital gains tax reporting extended. This article discusses the journey of capital gains tax CGT in the last. 20 on assets 28 on property.

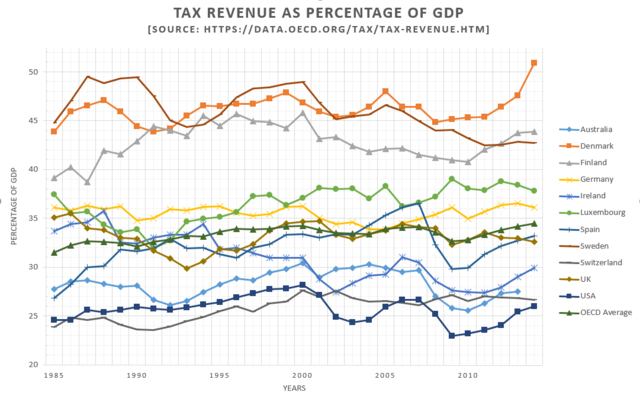

According to a House Ways and Means Committee staffer taxpayers who earn more than 400000 single 425000 head of household or 450000 married joint will be subject to the highest federal tax rate beginning in 2022. 2 days agoCapital gains tax receipts have doubled since 2017 hitting a record high of 146billion in the last year following the tax rise on entrepreneurs selling businesses. In the last six months the Office of Tax Simplification OTS has published two reports evaluating the effectiveness of the capital gains taxation system in the UK.

The capital gains tax rate upon the sale of a property depends on whether you have a basic or higher rate of tax with general-rate taxpayers paying 18 and higher-rate taxpayers paying 28 respectively. After selling an asset you only owe Capital Gains Tax on profits above 12300. Capital gains tax will be raised to 288 percent according to House Democrats.

Theres talk of CGT capital gains tax increasing in the US if Biden gets in. Capital gains tax generated 106bn for the UK last year and this figure is set to rise as property and investment prices. When selling your property you have options that may decrease your debt or lower your taxes.

UK Capital Gains Tax. Tax rates on capital gains are set for 2021-22 and 2020-21. By the 201718 tax year it had reached 133.

Can You Avoid Capital Gains Tax By Buying A House. Its the gain you make thats taxed not the. Anything less than that is tax-free.

1 day agoSpring Statement announces an increase in the annual National Insurance Primary Threshold and the Lower Profits Limit from 9880 to 12570 from July 2022 to align with the income tax personal. As a US citizen or Green Card Holder receiving dividends in the UK is a unique situation. This allowance is the amount before any tax is payable.

The increase would be substantially bigger from 20 to 45 therefore it would be good to know if this does take place should assets be sold off before the end of this tax year. Make sure you do this by 31st January the tax year after you profit. Taxes on the gain from selling other assets rise to 10 for taxpayers with basic tax rates and to 20 for taxpayers with.

In the event of a property sale if the sale resulted in capital gains tax the profits will be taxed at 18 on the sale value or 28 on the income if the sale resulted in capital gains tax. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate taxpayers a rise of 25 for a higher and additional rate taxpayers. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely because of.

More closely aligning UK capital gains tax CGT rates with income tax rates could raise significant revenues for the UK a government-commissioned review has concluded. 45 on assets and property. 10 on assets 18 on property.

40 on assets and property. You know at the end of the day its a tax on profits they are actually realised profits. Here are a few places he may target to raise some more cash.

The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. When you earn more than 12300 during a tax year you will need to declare it to HMRC and file a tax return. There is a capital gains tax allowance that for 2020-21 is 12300 an increase from 12000 in 2019-20.

Income tax is charged at a basic rate of 20 per cent rising to 40 per. Another announcement in the Autumn Budget 2021 affects anyone who makes a capital gain after selling a property. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value.

Sinking Funds Can Keep You Afloat Sinking Funds Real Estate Investor Making A Budget

How Stock Options Are Taxed Carta

Https You 38degrees Org Uk Petitions Increase Tax On Unearned Assets Like Shares And Second Homes Bucket Email Blas Budgeting Open Letter Business Investment

Do I Have To Pay Capital Gains Tax When I Gift A Property The Telegraph In 2022 Capital Gains Tax Capital Gain Setting Up A Trust

When Does Capital Gains Tax Apply Taxact Blog

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How Do Taxes Affect Income Inequality Tax Policy Center

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Uk Capital Gains Tax For British Expats And People Living In The Uk Experts For Expats

What Is A Crypto Airdrop How Is It Taxed Koinly

Selling Stock How Capital Gains Are Taxed The Motley Fool

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Biden S Capital Gains Tax Hike Could Spark A Big Sell Off In Stocks Here S What That Means For The Market Capital Gains Tax Capital Gain Economic Analysis

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World